12 Nov How to Build a Tax-Smart Withdrawal Strategy in Retirement

How to Build a Tax-Smart Withdrawal Strategy in Retirement

You’ve worked hard to save for retirement — now comes the next challenge: making your savings last.

One of the biggest factors in whether your retirement income lasts is how you withdraw it. A thoughtful, tax-smart withdrawal strategy can help you preserve more of your savings, minimize tax surprises, and maintain flexibility in changing markets.

At Nova Wealth Management, based in Bonita Springs and serving Naples, Marco Island, Estero, Fort Myers, and surrounding Southwest Florida communities, we help clients coordinate their investments, income, and tax strategies to create efficient, sustainable withdrawal plans.

Here’s what every retiree should know.

What Is a “Tax-Smart” Withdrawal Strategy?

A tax-smart withdrawal strategy is a plan for deciding:

Which accounts to draw from, and

When to take those withdrawals

…so you can reduce taxes over time rather than just in a single year.

By sequencing withdrawals intentionally, you can manage your tax bracket, avoid penalties, and even reduce future required minimum distributions (RMDs).

→ Learn more: Retirement Tax Planning Services

1. Know Your Account Types

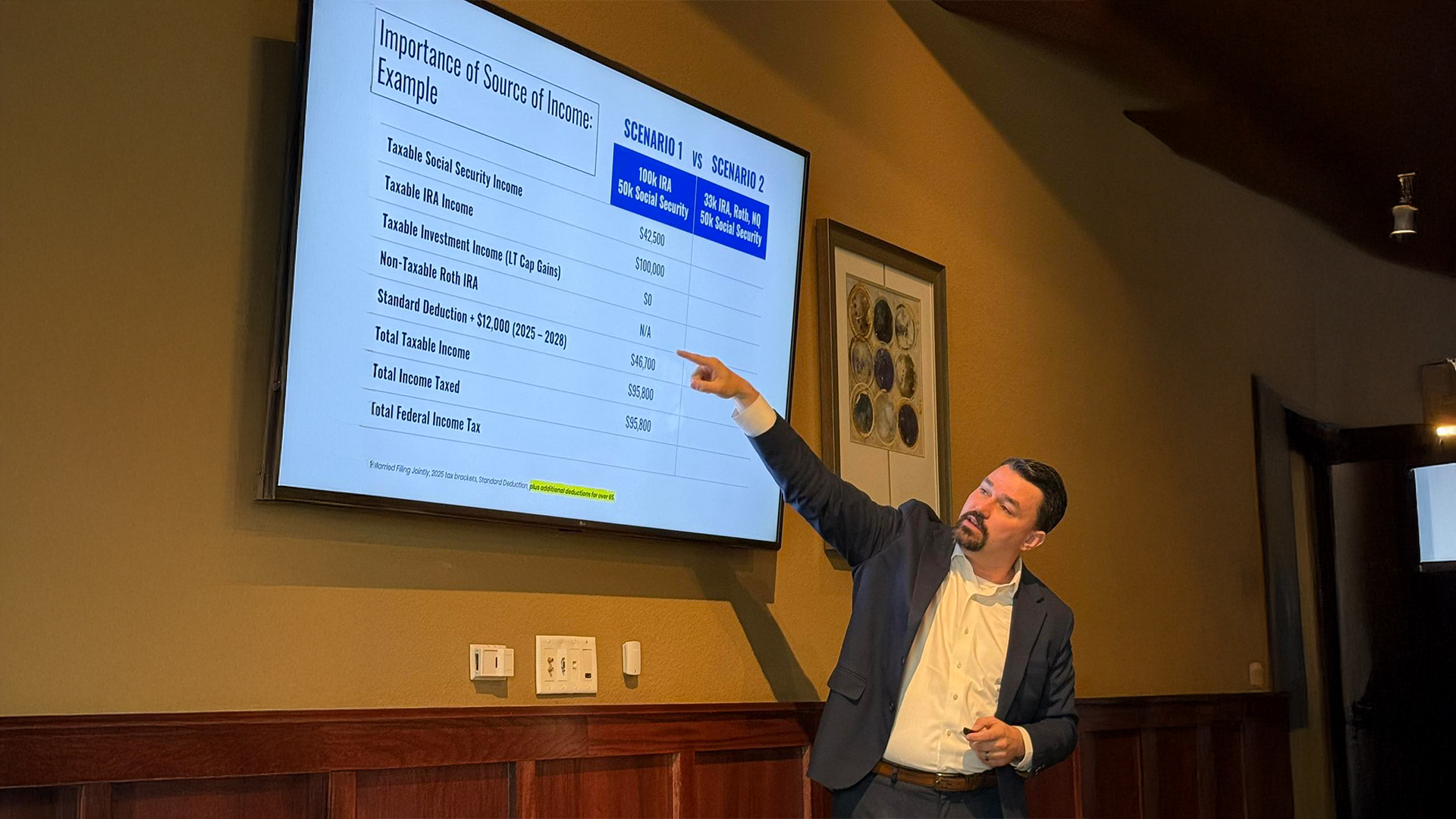

Different retirement accounts are taxed differently — and that matters for withdrawal order.

Tax-Deferred Accounts: Traditional IRA, 401(k), 403(b)

Taxes are due when you withdraw.

Tax-Free Accounts: Roth IRA, Roth 401(k)

Withdrawals are tax-free in retirement (if qualified).

Taxable Accounts: Brokerage, savings, or CDs

You pay ongoing taxes on dividends, interest, and capital gains.

A blended approach — using all three types in a strategic sequence — gives you flexibility and control over your taxable income year-by-year.

2. Sequence Withdrawals to Manage Tax Brackets

Without planning, you might withdraw from multiple accounts at once — potentially pushing yourself into a higher tax bracket.

A better approach:

First: Use taxable accounts (to take advantage of capital gains rates).

Next: Draw from tax-deferred accounts (IRA, 401(k)) as needed.

Lastly: Preserve Roth assets for later years or heirs.

This order isn’t right for everyone, but it can help smooth out your taxable income across decades instead of spiking it early.

→ Related: Retirement Income Planning

3. Coordinate With Social Security

Your Social Security benefits can be taxable, depending on your total income.

Up to 85% of benefits may be taxed if your income exceeds certain thresholds.

A tax-smart withdrawal plan looks at the timing of your first Social Security payment alongside IRA withdrawals and RMDs to minimize overlap — and lower taxes on your benefits.

4. Don’t Overlook RMDs

At age 73 (for most retirees), the IRS requires you to begin taking Required Minimum Distributions (RMDs) from most retirement accounts.

Tip: If you start smaller withdrawals earlier or convert part of your IRA to a Roth, you can reduce future RMD amounts — helping you avoid higher taxes and Medicare premium surcharges later on.

5. Use Charitable Giving Strategically

If you’re charitably inclined, Qualified Charitable Distributions (QCDs) from your IRA can satisfy RMDs tax-free.

This allows you to support causes you care about while lowering your taxable income.

6. Plan Year-to-Year

A withdrawal strategy isn’t static. Review it annually to:

Adjust for tax law changes

Rebalance investments

Coordinate with market returns and cash needs

Update based on health care or lifestyle changes

Working with a fiduciary team ensures your plan remains flexible and compliant while prioritizing what matters most to you.

→ You might also explore: Legacy & Estate Planning Services

TL;DR — How to Build a Tax-Smart Withdrawal Strategy

Understand how each account type is taxed.

Sequence withdrawals to control taxable income.

Coordinate timing with Social Security benefits.

Plan for RMDs before they start.

Use QCDs or charitable giving to reduce taxes.

Review and adjust your strategy annually.

A smart withdrawal plan can add years to your retirement income longevity.

Next Steps

If you live in Bonita Springs, Naples, Marco Island, Estero, or Fort Myers, and want to make your retirement withdrawals more tax-efficient, we’d love to help.

Contact Us or call 1-888-677-9910 to schedule a personalized consultation.

No Comments